Step inside a cannabis dispensary for the first time and the experience can be overwhelming. The meticulously labeled glass jars showcase dozens of strains with names like "Wedding Cake" and "Blue Dream," while refrigerated cases display concentrates, edibles, and tinctures at wildly different price points. Unlike the days when consumers were limited to whatever their neighborhood dealer offered, today's legal market presents a dazzling array of options that might leave newcomers with both wonder and sticker shock.

One thing customers notice immediately: not all cannabis is priced equally. A gram of one strain might cost an affordable $4 while another could command premium prices that seem puzzlingly high. This price disparity raises questions for both newcomers and experienced consumers alike. Is expensive weed worth it, or are you simply paying a "hype tax"?

The Economics Behind Cannabis Pricing

The cannabis industry operates under unique market conditions shaped by several interconnected factors:

Federal Regulations and Their Ripple Effects

Despite growing state-level legalization, the federal government's classification of marijuana as a controlled substance creates complications that directly impact pricing:

- Banking restrictions force many businesses to operate cash-only, increasing security costs

- Interstate commerce prohibition prevents efficient supply chain optimization

- Tax code section 280E prevents cannabis businesses from deducting ordinary business expenses, significantly increasing their effective tax rates

A 2023 industry analysis estimated these federal constraints add 30-40% to operational costs compared to similar retail businesses. When combined with state-specific licensing fees that can reach into hundreds of thousands of dollars annually, these regulatory hurdles create substantial overhead costs that inevitably get passed to consumers.

Cultivation Methods Matter

The way cannabis is grown dramatically affects both its quality and price:

Indoor cultivation requires substantial investment in specialized equipment—lighting systems, climate control, ventilation, and precise nutrient delivery systems. These controlled environments allow for year-round growing with consistent results but at higher production costs.

Outdoor cultivation harnesses natural sunlight and soil, drastically reducing production costs. However, outdoor grows are subject to seasonal limitations, weather risks, and typically produce one or two harvests annually.

Greenhouse and mixed-light cultivation offers a middle ground, using natural sunlight supplemented with artificial lighting while providing some environmental controls.

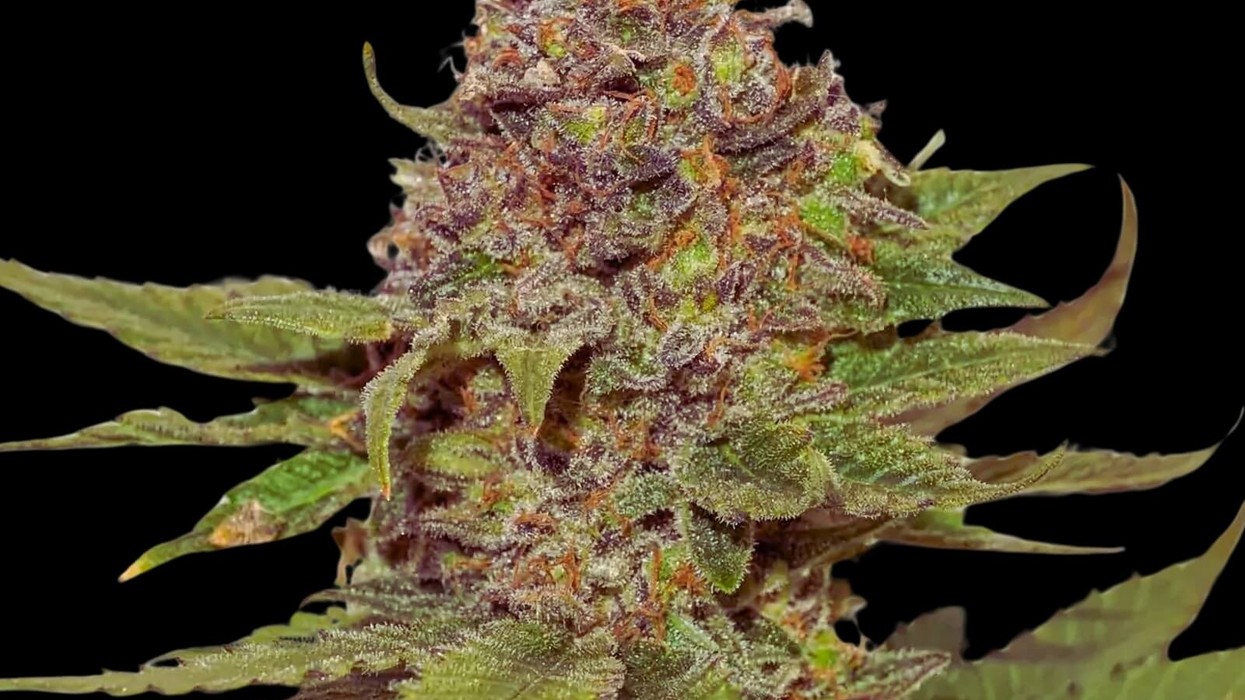

John Kaye, co-founder of cannabis retailer Burb, explains that cultivation method directly impacts the final product: "The nose (does it smell pungent/pleasant?), color (look for vibrant green buds with orange/red hairs), feel (is it sticky, dense?), burn (how clean does it smoke?)—these qualities often correlate with production methods."

Quality Indicators and Their Price Impact

Several factors signal premium cannabis that commands higher prices:

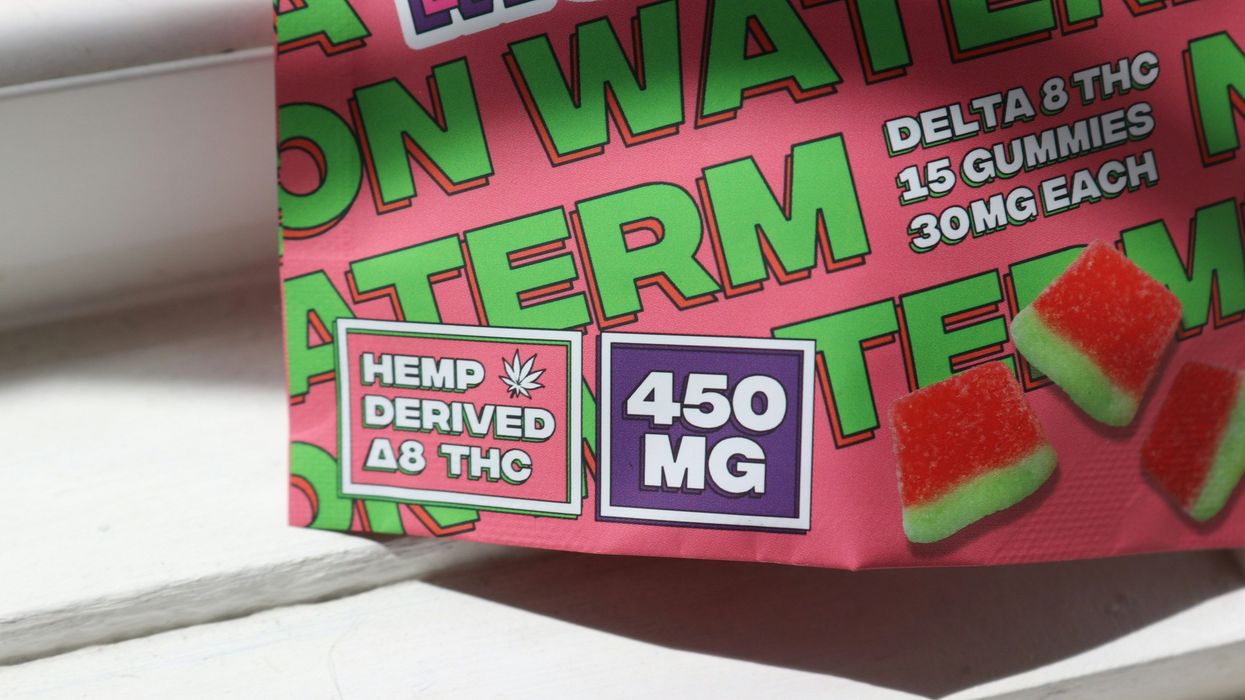

- Cannabinoid profile: While THC percentage remains a key pricing factor, the industry is increasingly recognizing the value of balanced cannabinoid profiles and diverse terpene content. Premium products often feature precise ratios of THC, CBD, CBG, and other cannabinoids targeted for specific effects.

- Terpene preservation: These aromatic compounds not only create the plant's distinctive scents but significantly influence its effects through what scientists call the "entourage effect." Premium cultivation and processing methods preserve these delicate compounds.

- Appearance: Properly cultivated, trimmed and cured cannabis displays vibrant colors, visible trichomes (the crystal-like structures containing cannabinoids), and proper moisture content without being too dry or too damp.

- Proper curing: This meticulous post-harvest process can take 2-8 weeks as opposed to rushed methods that might take just days. Proper curing preserves cannabinoids and terpenes while removing chlorophyll and other compounds that create harsh smoke.

- Clean cultivation: Premium products increasingly emphasize organic growing methods that avoid harsh pesticides, producing a cleaner final product. Lab testing verifies not just potency but the absence of contaminants, molds, or chemical residues.

The Brand Factor

Like other consumer goods, branding significantly influences cannabis pricing. An anonymous former dispensary inventory manager in Colorado (whom we'll call Keith) revealed: "Some growers get a name for themselves and raise prices accordingly. Customers are at times paying more for the grower's reputation than the objective quality of their product."

This aligns with broader retail principles. "It's all about the same things as prices in any other business: the profit they hope to gain based on what it costs them to have the product, and customer perceptions of what is worth that price," Keith explained.

Local Market Dynamics

Cannabis pricing also responds to local market conditions:

- Market maturity: Newer legal markets typically have higher prices that gradually decline as more businesses enter the space and production capacity increases.

- Taxation structure: State and local cannabis taxes vary dramatically, from modest to punitive, directly affecting final consumer prices.

- Competition density: Areas with numerous dispensaries typically see more competitive pricing than those with limited retail options.

The Consumer Perspective

Cannabis consumers navigate these pricing factors differently based on their priorities and experience levels.

Some, like 38-year-old Colin, believe quality differences justify price premiums: "Those differently priced strains probably don't look the same or smell the same. There are probably large quality differences in the final product that account for the price difference."

Others approach the market more skeptically. Corey, a 34-year-old dance instructor from Chicago, suggests high prices sometimes exploit novice consumers: "The average person is exactly who dispensaries want coming through those doors because they can tell you weed will give you energy and you'll believe them for some reason."

Many consumers find themselves balancing budget with quality preferences. "The cheap stuff ruins my throat. The good stuff ruins my wallet," one consumer told us. "The fact that we can get it legally, though, is priceless."

Navigating Price vs. Value: A Consumer Guide

For consumers seeking to maximize value, industry experts recommend considering:

- Personal tolerance and needs: Higher-potency products might provide better value for experienced consumers despite higher upfront costs. If 10mg of THC produces your desired effect, a $40 product with 200mg total THC (20 doses) may offer better value than a $20 product with 50mg (5 doses).

- Consumption method efficiency: Different methods have vastly different bioavailability rates. Smoking and vaping typically deliver 10-35% of cannabinoids to your bloodstream, while edibles might deliver only 4-12% (but with longer-lasting effects). This efficiency directly affects the real cost per experience.

- Dispensary loyalty programs: Many retailers offer significant discounts (10-15%) for returning customers or first-time visitors. Taking advantage of these programs can substantially reduce costs without sacrificing quality.

- Targeted terpene profiles: Sometimes mid-priced products with specific terpene combinations (like myrcene for relaxation or limonene for mood elevation) offer precisely the effects a consumer wants without premium pricing.

- Transparency in testing: Reputable producers provide comprehensive lab results confirming not just potency but also terpene profiles and the absence of contaminants, pesticides, and heavy metals. This information helps ensure you're getting what you pay for.

- Harvest and package dates: Freshness significantly impacts quality, with properly stored cannabis maintaining optimal properties for about six months. Products approaching their one-year mark often sell at discount but may have diminished potency and terpene content.

Market Maturation: The New York Example

The evolution of cannabis pricing becomes clearer when examining maturing markets like New York. Recent data shows the average price for 3.5 grams of cannabis at New York dispensaries has fallen from $41.13 when legal sales launched in 2022 to $38.96 in early 2025. The price drops extend across product categories, with one gram of concentrate decreasing from $58.92 to $50.30 and one-gram vape products dropping from $64.89 to $55.35, according to a New York Office of Cannabis Management (OCM) analysis.

John Kagia, OCM's executive director of market policy, innovation, and analytics, attributes these shifts to increasing competition: "Retailers are adjusting their prices as part of their competitive strategy as more locations have opened. While it remains a little early to determine all the factors driving the retail price compression, it is common to see price compression as new markets mature and competition intensifies."

New York's cannabis ecosystem now features over 500 brands with approximately 370 retail locations, creating a competitive landscape that benefits consumers through lower prices. "Lower prices indicate a growing diversity of products available in the market," Kagia notes. "They increase affordability for consumers and enable the legal market to compete more effectively against the illicit market."

This market evolution has impacted dispensary revenues as well. While sales revenues per dispensary reached $599,000 in August 2024, by February 2025 that figure had dropped to $351,000 per store. Despite these per-location decreases, New York's overall cannabis market remains robust, with total sales reaching $1.46 billion since the launch of adult-use sales and on pace to hit $1.5 billion in 2025 alone.

The Future of Cannabis Pricing

As legal markets continue maturing nationwide, several trends are emerging:

- Price normalization: Initial high prices in new markets typically decline as production scales up and competition increases, as demonstrated by New York's experience.

- Quality stratification: Like wine or coffee markets, cannabis is developing distinct price tiers based on objective quality differences and production methods.

- Consumer education: As buyers become more knowledgeable, pricing based purely on THC percentage or marketing hype becomes less effective.

- Production efficiencies: Improved growing techniques and technology are helping producers deliver higher quality at lower cost.

A Market Finding Its Equilibrium

The legal cannabis industry continues evolving rapidly, with pricing structures that reflect its unique regulatory challenges, production complexities, and maturing consumer preferences. This evolution demonstrates classic economic principles at work, as markets move from novelty pricing toward equilibrium.

"We're witnessing what economists would call market normalization," says Dr. Beau Whitney, founder of Whitney Economics, a leading cannabis economic research firm. "The initial premium pricing we see in new markets reflects limited supply meeting pent-up demand, but with time, production capacity increases, competition intensifies, and prices tend to stabilize at levels that balance producer profitability with consumer affordability."

For shoppers navigating this complex landscape, understanding the factors behind cannabis pricing helps them make choices aligned with both their preferences and budgets. The education gap between newcomers and experienced consumers is narrowing as dispensary staff improve their ability to guide customers through the range of options.

Whether seeking budget-friendly options or premium craft cannabis, today's consumers benefit from unprecedented choice and transparency—a welcome change from the days when whatever the dealer had was the only option available. The industry's ongoing price evolution reflects not just changing consumer preferences and growing competition, but also cannabis's gradual transition from forbidden substance to mainstream consumer product.

High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

The Proposed Hemp Ban That Would Destroy a $28 Billion Success Story - The Bluntness Photo by

The Proposed Hemp Ban That Would Destroy a $28 Billion Success Story - The Bluntness Photo by