Two years into New York's adult-use cannabis rollout, the state's Office of Cannabis Management (OCM) has dropped its most comprehensive look yet at the market's performance, challenges, and opportunities. The 2024 OCM Market Report is packed with impressive numbers and lofty intentions, but peel back the layers and a more complicated story unfolds—one where equity goals face harsh economic headwinds, regulatory delays hamper progress, and a persistent illicit market looms large.

Here's what you need to know:

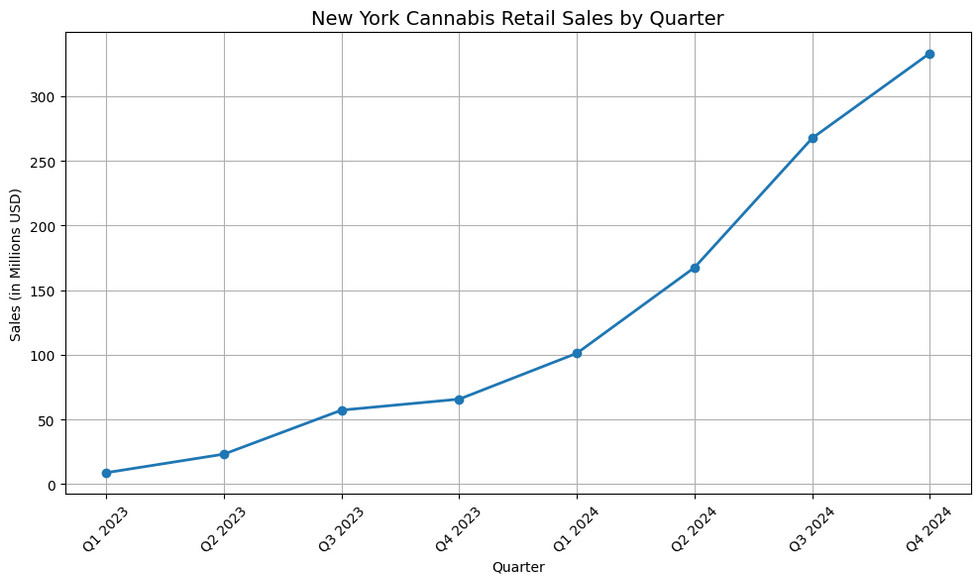

$1 Billion and Counting: A Sales Surge Worth Celebrating

As of the end of 2024, New York's legal adult-use cannabis market has generated more than $1.02 billion in retail sales, with $869 million of that coming in 2024 alone. The fourth quarter of 2024 shattered records with over $333 million in sales. By April 2025, the number of licensed dispensaries had climbed to 363.

That's no small feat for a state that only began regulated adult-use sales in December 2022. Consumer demand is clearly there—particularly in downstate regions like Manhattan, Queens, and Long Island, which accounted for over 58% of total sales.

But before we light a joint in celebration, let’s take a closer look at the fine print.

Equity on Paper, But Economic Reality Bites

The MRTA's mandate that 50% of licenses go to social and economic equity (SEE) applicants has technically been met—54% of adult-use licenses were issued to SEE applicants as of December 2024. CAURD licensees, many of whom are justice-involved, make up 70% of all open dispensaries.

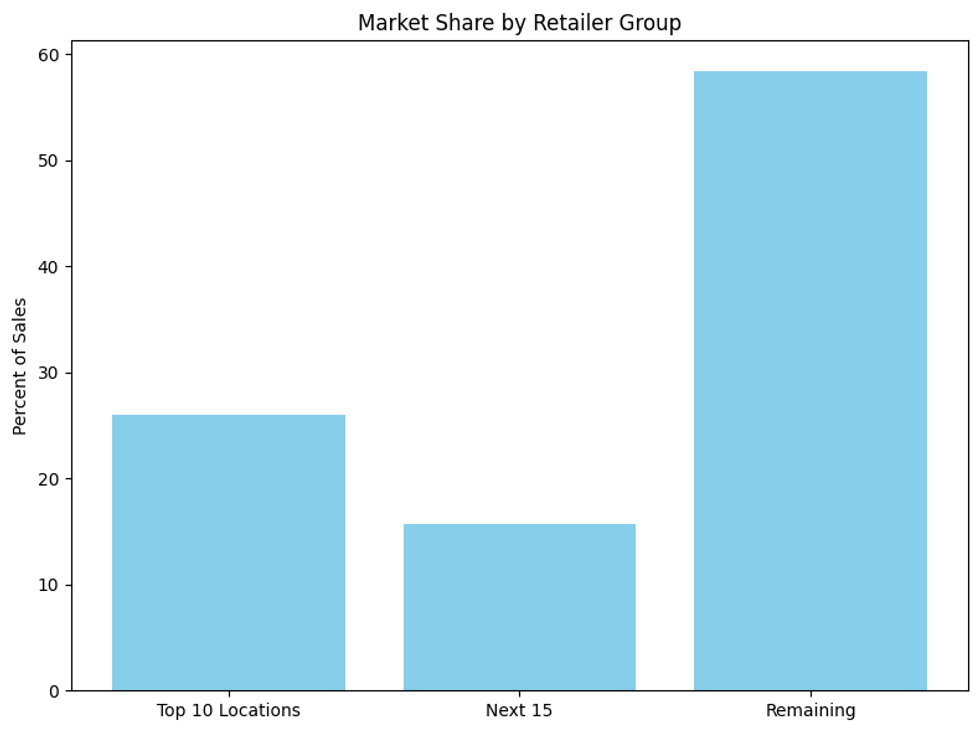

Still, the financial picture is grim for many of these operators. Over one-third of dispensaries are generating under $2 million annually—a threshold considered unsustainable in most regions due to high operating costs and steep taxes. Meanwhile, just 10 shops account for 26% of total sales.

Despite fee waivers and state support, the data suggest that equity licensees are struggling to survive, let alone thrive. The state's well-intentioned goals risk being undermined by market dynamics that favor capital-rich players, including the Registered Organizations (ROs) who are already outperforming in terms of sales per location.

Taxation Nation: A Competitive Disadvantage

New York's cannabis tax structure remains a sore spot. With a 13% retail excise tax layered on top of local sales tax and additional THC potency taxes (though now repealed), legal operators face margins that are razor-thin. That gives illicit operators—still prevalent in many parts of the state—a distinct price advantage.

Even with increased enforcement and over 1,500 illicit stores shut down, the black market continues to flourish, undermining legal businesses and depriving the state of much-needed revenue.

License Backlogs, Delays, and Confusion

Licensing delays and litigation have hampered the industry from day one. Although over 1,600 licenses were issued by the end of 2024, only a fraction of them are operational. Many applicants have waited months for updates, even after securing real estate and investing heavily.

OCM's new "single point of contact" model aims to streamline the process, but trust is still being rebuilt. The LOCAL Map tool is a step in the right direction, but many operators still face steep learning curves and a minefield of regulatory compliance.

Consumer Trends: Edibles, Vapes, and Bigger Brands

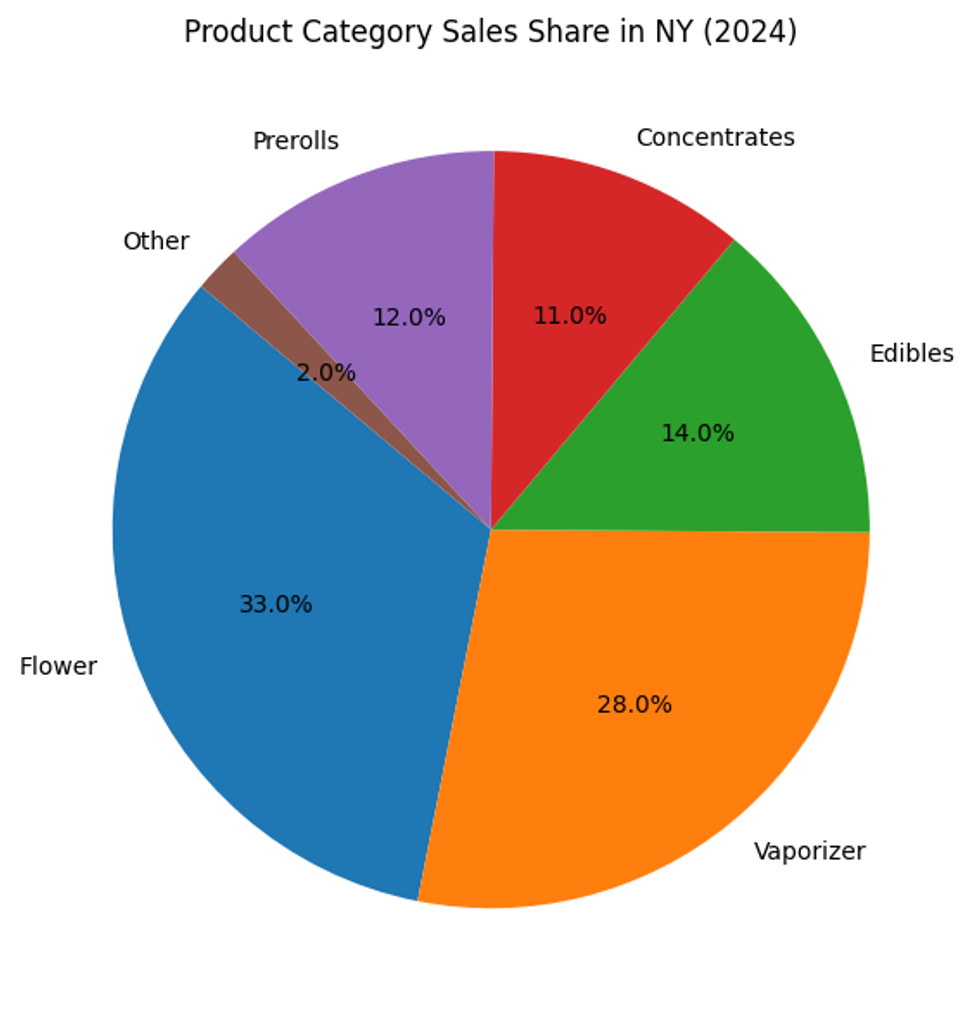

Flower still leads the way at 33% of sales, but consumer demand is shifting. Vaporizers (28%), edibles (14%), and concentrates (11%) are gaining traction. Price-conscious buyers are gravitating toward value options, particularly ounce-sized packages from ROs, which are cheaper on average than those from adult-use cultivators.

Brand loyalty is starting to emerge, with the top 5 brands accounting for 21% of total sales and the top 20 capturing nearly half. However, over 500 brands are currently in the market, and competition is fierce.

Retail Disparity: A Tale of Two Markets

While sales are booming in Downstate regions, the Upstate market tells a different story. Despite having more open dispensaries, Upstate regions only accounted for 42% of reported sales in 2024. Dispensaries in less densely populated areas face longer ramps, higher per-store operating costs, and less customer traffic.

Moreover, while ROs and a handful of high-performing CAURD stores dominate sales, the bottom third of licensees are operating below breakeven. Many SEE licensees are still in limbo due to financing, construction, and municipal zoning delays, putting them at risk of falling behind before they ever open their doors.

What Needs to Happen Next?

The OCM recommends:

- Continuing to prioritize and support SEE operators with real financial tools.

- Streamlining the licensing process with more transparency and accountability.

- Re-evaluating tax policies to make legal products competitive with the illicit market.

- Encouraging brand diversity and innovation to capture more market share.

- Strengthening data systems to improve market monitoring and consumer safety.

But recommendations alone won't fix structural issues. If New York wants to fulfill its promise of a socially equitable, thriving cannabis market, it must move faster, regulate smarter, and tax more fairly.

Because if not, the state's billion-dollar baby may never grow up.

Blunt Verdict: Progress, Yes. But Let’s Not Confuse Motion with Momentum.

High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

When it comes to pricing, cultivation methods matter - The Bluntness

Photo by

When it comes to pricing, cultivation methods matter - The Bluntness

Photo by