The Drug Enforcement Agency (DEA) hasn't seen any reason to remove cannabis from its list of Schedule I banned substances. Yet, cannabis in its myriad forms is pulling in billions of dollars in vital tax revenue for those states where it is legal —$3 billion in 2022 alone.

The drug has sat in the Schedule I classification alongside heroin, peyote, and other substances the DEA considers to have a high potential for abuse since 1970, when Congress enacted the Controlled Substances Act, making it federally illegal to possess them. Two decades after the law passed, following intense social pressure that segued into the realization of a new tax opportunity, certain states began to make the drug available to residents, citing the medical benefits and relative safety compared with other substances

In light of the rise in cannabis availability (to say nothing of popularity), the Biden administration passed a landmark law in December 2022, allowing the federal government to study its effects for the first time to a greater degree.

The first state to legalize marijuana use in a medical capacity was California, which did so in 1996. Today, marijuana is legal for medical use in 38 states and four territories, including Guam and the Virgin Islands, according to the nonprofit NORML, which advocates for marijuana legalization and regulation on par with that of alcohol.

In the intervening years, more states have made a move to legalize and regulate sales or, at the least, decriminalize cannabis use. In 2022, five states voted on recreational cannabis use, with two—Maryland and Missouri—approving such measures. The taxes generated by cannabis and cannabis-related sales benefits programs and state-level institutions, including education systems, correctional facilities, fire departments, and transportation initiatives.

Data from Urban Institute was used to rank states by the share of 2022 tax revenue they collected through recreational-use cannabis excise taxes, breaking ties by total cannabis tax revenue. The data is limited to the 11 states that collected a cannabis excise tax from July 2021 through June 2022. An excise tax is paid on a manufactured good, like plant byproducts, at its point of sale. There are three ways cannabis products can be taxed: by a standard percentage of the price, by weight, and by the relative potency of the product.

Technically, levying cannabis taxes is still illegal under federal law, but 19 states have enacted cannabis tax legislation as of September 2022. Connecticut, New York, Rhode Island, Vermont, and Virginia have passed laws enacting cannabis taxes, but at the time of data collection, sales were not legal yet. Washington D.C. allows the legal sale of cannabis, but Congress prevents it from levying taxes on legal sales. Minnesota allows the purchase of some THC-infused products, but does not levy a cannabis tax.

#11. Maine

- Share of tax revenue from cannabis excise taxes: 0.3%

- Statewide cannabis excise tax revenue: $18.2 million

--- Per capita: $13

Maine legalized the recreational use of cannabis in 2016 for adults 21 years of age and older. Cannabis sales did not begin, however, until October 2018, and taxation did not pick up until November 2020.

#10. California

- Share of tax revenue from cannabis excise taxes: 0.3%

- Statewide cannabis excise tax revenue: $774.4 million

--- Per capita: $20

California, forever the first state to dive into the wild world of cannabis legalization, collected more in cannabis sales taxes than any other state in 2022. One reason behind that is, despite the repeal of a weight-based tax, the state levies a 15% excise tax, and some local-level governments also add a gross receipts tax, which often carries down to the individual buyer.

#9. Massachusetts

- Share of tax revenue from cannabis excise taxes: 0.4%

- Statewide cannabis excise tax revenue: $156.7 million

--- Per capita: $22

The state of Massachusetts last year became the first state to add lessons about marijuana-impaired driving to its driver's license curriculum for new drivers. The state passed reforms to its marijuana laws in 2022 that will place 15% of marijuana excise taxes in a fund to support diversity in the marijuana retail industry, which white men dominate.

#8. Michigan

- Share of tax revenue from cannabis excise taxes: 0.4%

- Statewide cannabis excise tax revenue: $163.5 million

--- Per capita: $16

In November 2018, Michigan became the first Midwestern state to legalize both medical and recreational marijuana use. The state sends millions of tax dollars from drug sales to its public schools and public transportation sectors.

#7. Arizona

- Share of tax revenue from cannabis excise taxes: 0.6%

- Statewide cannabis excise tax revenue: $132.8 million

--- Per capita: $18

In March 2022 alone, marijuana sales generated more tax revenue for Arizona than tobacco and alcohol sales combined. Those taxes help fund public schools. As of 2021, the state also passed a law that has allowed people with marijuana charges on their record to get them expunged.

#6. Illinois

- Share of tax revenue from cannabis excise taxes: 0.8%

- Statewide cannabis excise tax revenue: $466.8 million

--- Per capita: $37

Anyone 21 years of age or older has been able to buy recreational weed in Illinois since the start of 2020. The tax revenues fund social programs for housing and mental health. The state levies gross receipts and potency taxes.

#5. Oregon

- Share of tax revenue from cannabis excise taxes: 1.0%

- Statewide cannabis excise tax revenue: $170.6 million

--- Per capita: $40

In Oregon, revenues from marijuana sales tax go to a number of places, including police budgets, municipalities, and health systems. The largest portion—40%—is devoted to the state's school fund.

#4. Alaska

- Share of tax revenue from cannabis excise taxes: 1.2%

- Statewide cannabis excise tax revenue: $28.9 million

--- Per capita: $39

More than 3% of all taxes collected in Alaska in 2021 came from marijuana sales. While that figure dropped the following year, the tax funds nonetheless benefited drug treatment programs and initiatives to keep the formerly incarcerated from ending up back in jail.

#3. Washington

- Share of tax revenue from cannabis excise taxes: 1.5%

- Statewide cannabis excise tax revenue: $517.0 million

--- Per capita: $67

Washington State has enjoyed legal recreational marijuana for nearly an entire decade now. Those tax dollars fund health care, state police, and local government budgets.

#2. Nevada

- Share of tax revenue from cannabis excise taxes: 1.7%

- Statewide cannabis excise tax revenue: $152.3 million

--- Per capita: $48

In 2019, Nevada passed a law directing all marijuana tax revenues to public education. The state still prevents the sale and use of marijuana at large events.

#1. Colorado

- Share of tax revenue from cannabis excise taxes: 1.7%

- Statewide cannabis excise tax revenue: $353.7 million

--- Per capita: $61

Colorado wins above all other states, bringing in the largest share of its taxes via marijuana excise taxes. The tax revenue goes toward housing, mental health care, rehabilitating older school buildings, and other social programs.

Original article source: Stacker

The Dominoes Are Falling Nationwide as Federal Prohibition Ends

The Dominoes Are Falling Nationwide as Federal Prohibition Ends

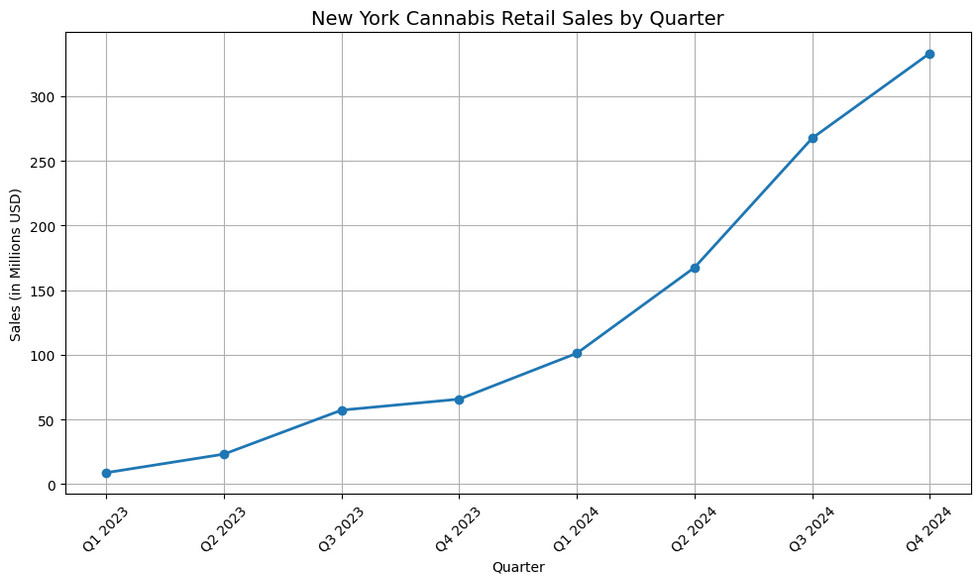

New York Cannabis Retail Sales by Quarter - 2024 - The Bluntness

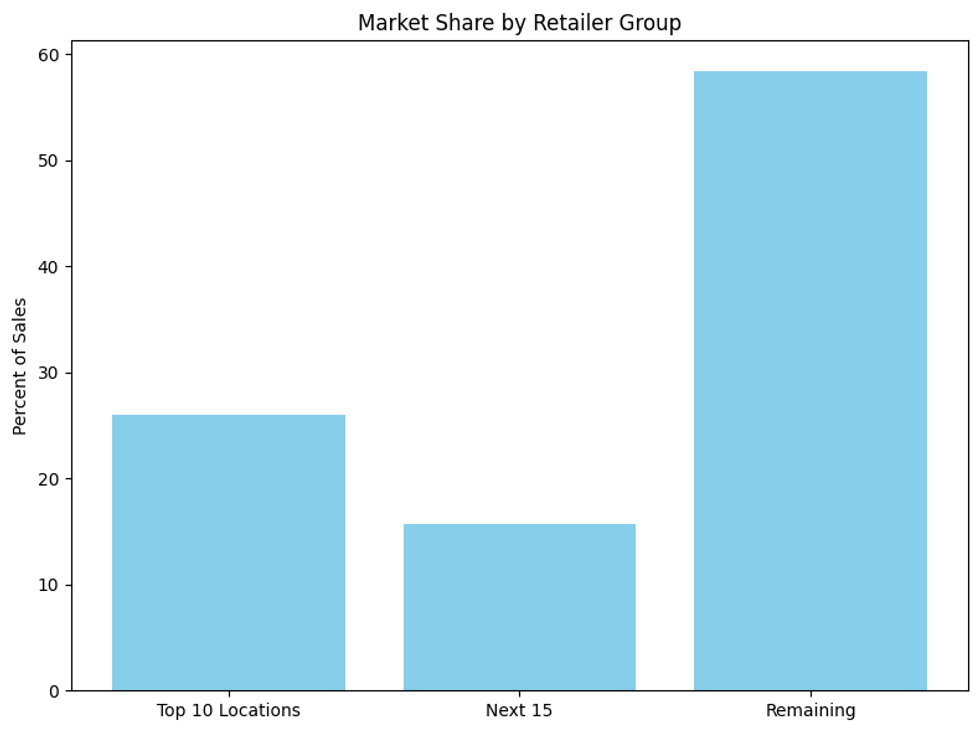

New York Cannabis Retail Sales by Quarter - 2024 - The Bluntness 2024 New York Market Share by % of Sales - The BluntnessThe Bluntness

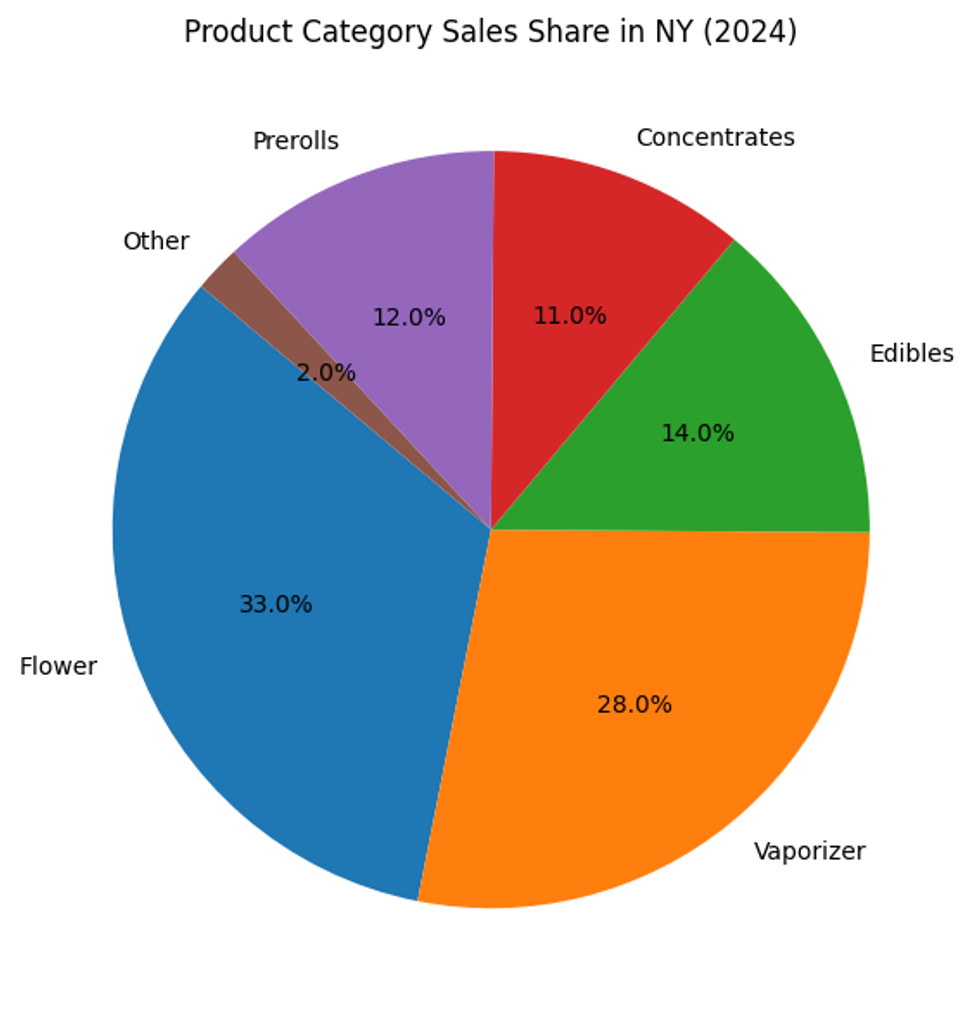

2024 New York Market Share by % of Sales - The BluntnessThe Bluntness Share of market by product category according to 2024 OCM Report - The Bluntness

Share of market by product category according to 2024 OCM Report - The Bluntness

Grateful Dead's Jerry Garcia

Grateful Dead's Jerry Garcia Scene from Reefer Madness

Scene from Reefer Madness  Getting high w/ Awkwafina

Getting high w/ Awkwafina