WNBA Superstar Brittney Griner Detained in Russia over Alleged Cannabis Possession

March 8, 2022 -- Brittney Griner, two-time Olympic Gold medalist and seven-time WNBA all-star, is in serious trouble.

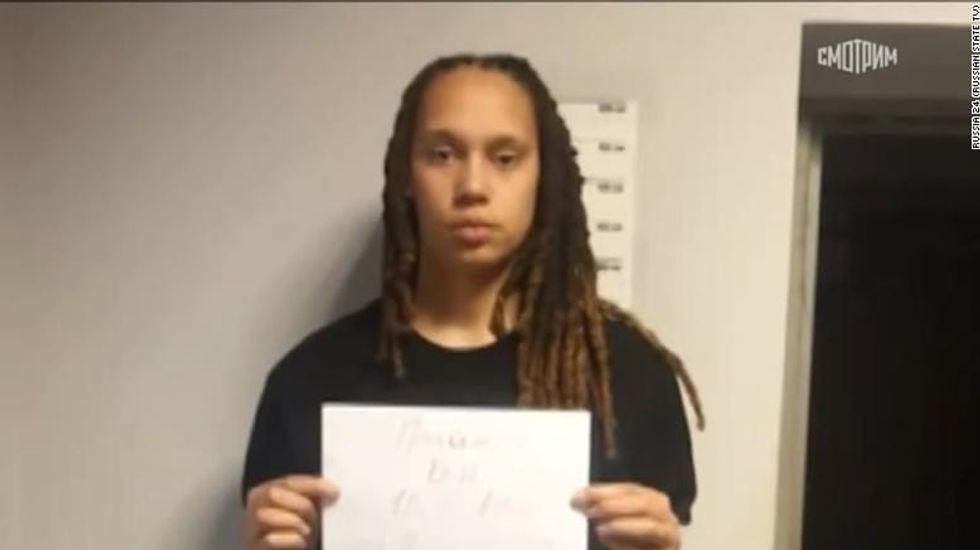

The Russian Federal Customs Service released a statement on Saturday, confirming they had detained the 31-year-old superstar athlete in a Moscow airport last month after agents supposedly found cannabis vape cartridges in her luggage.

The Russian Federal Customs Service have released this video in which airport security are seen going through the luggage of a passenger identified as Brittney Griner. pic.twitter.com/gHJ8XoMYvF

— Bryan Armen Graham (@BryanAGraham) March 5, 2022

It's not clear where Griner is being held or how long she's actually been detained, although rumors suggest it started around the NBA All-Star weekend (Feb 19-21).

Also notable is that her case has flown under the radar for so long before finally breaking headlines.

What was Griner doing in Russia?

Many WNBA players spend their offseasons playing overseas for the oftentimes higher salaries.

Griner, one of the most decorated women in basketball, has played for the Russian club UMMC Ekaterinburg during her offseasons since 2015. Just last year, she helped the club win the EuroLeague Women championship.

Griner has spent her entire WNBA career with the Phoenix Mercury, who drafted her with the number one pick in 2013. She led the franchise to its third WNBA title in 2014 as well as a “surprise” return to the finals this past October.

Additionally, Griner is an outspoken advocate in the LGBTQ+ community, which is also heavily frowned upon in Russia.

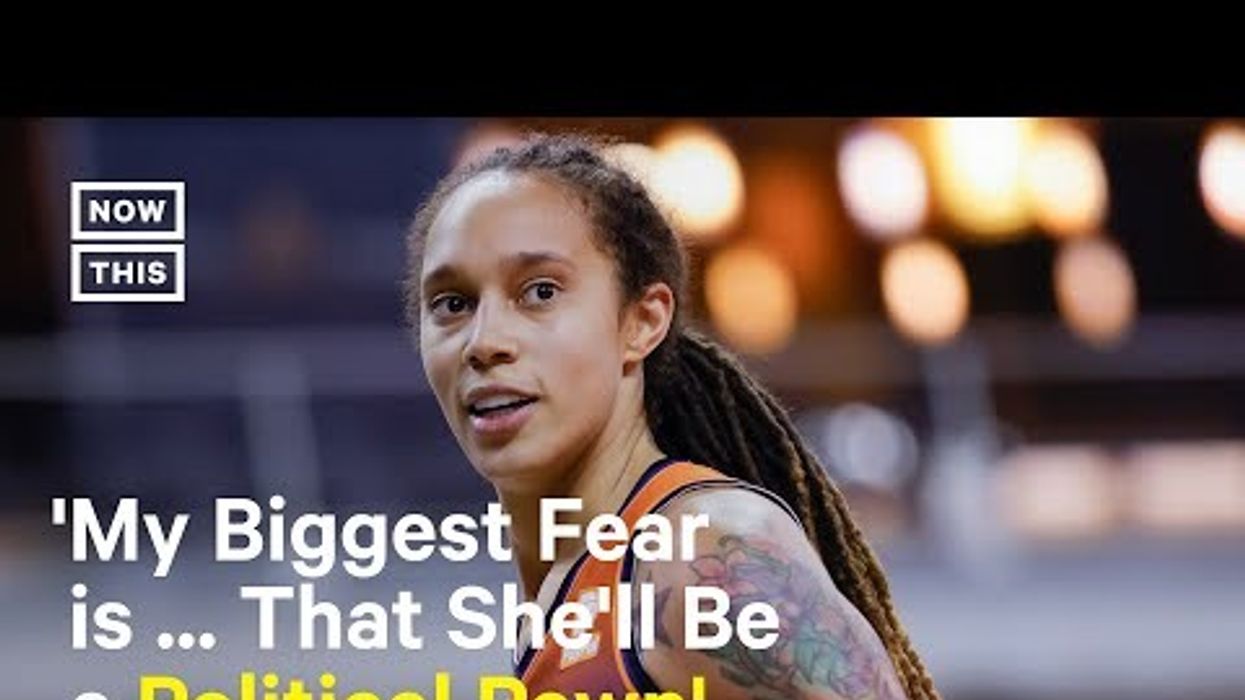

As Vladimir Putin leads Russia toward a third week of invasion in Ukraine, getting Griner out of Russia will be no easy task.

The Biden administration is working on it, according to the Congressional Black Caucus.

However, the only good news at this point is that Griner's current plight is on peoples’ agendas.

"Our diplomatic relationships with Russia are nonexistent at the moment," Democratic Rep. John Garamendi of California told CNN, adding that Russia also has very strict LGBT laws.

"Perhaps during the various negotiations that may take place, she might be able to be one of the solutions. I don't know."

As Griner’s supporters, friends, and family clamour for her release, the grim reality is that she could potentially face a 10-year prison sentence in Russia.

Check out the petition for Griner’s release over at Change.org.

Need a little more Bluntness in your life? Sign Up for our newsletter to stay in the loop.

High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by

High-THC Weed Explored - The Bluntness Photo by  High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

High-THC Weed Explored - The Bluntness Photo by Maria Fernanda Pissioli on Unsplash

The Proposed Hemp Ban That Would Destroy a $28 Billion Success Story - The Bluntness Photo by

The Proposed Hemp Ban That Would Destroy a $28 Billion Success Story - The Bluntness Photo by