The emerging United States legal cannabis industry is facing many hurdles, with one of the biggest hurdles being a lack of access to the nation’s banking system. The problem is not as great as it once was, however, it’s still a major issue for many cannabis companies and the cannabis industry will never reach its full potential without adequate banking options.

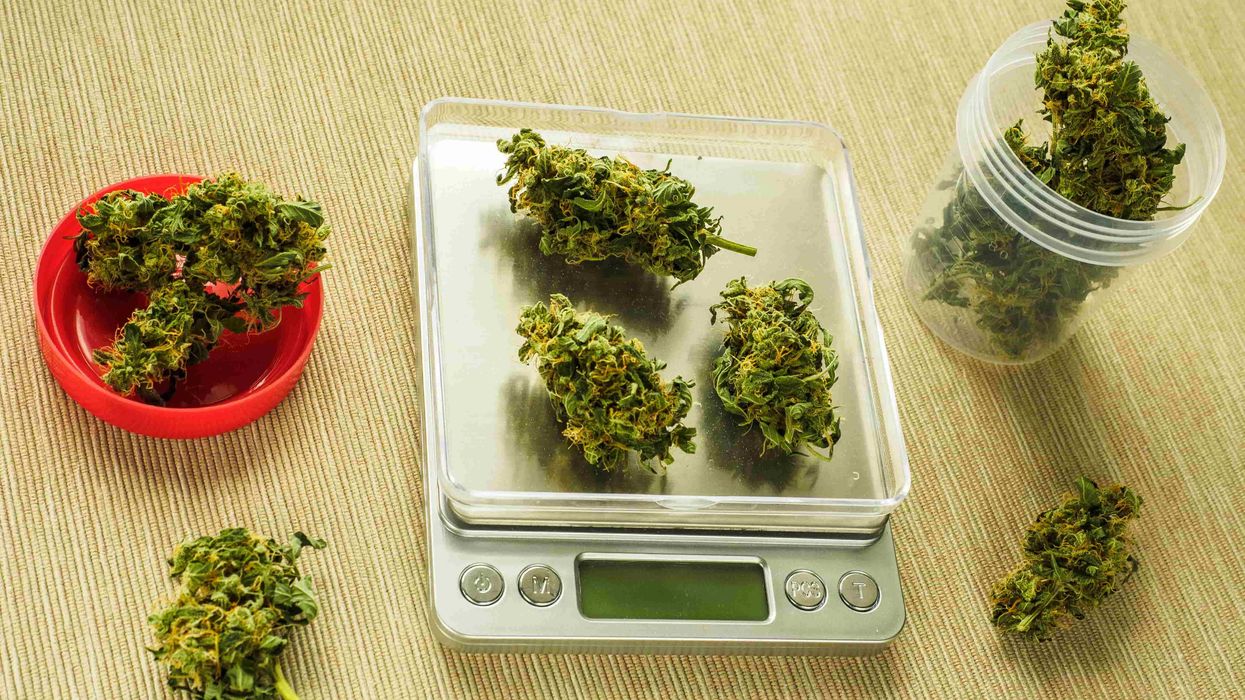

Too many cannabis companies, especially those who ‘touch the plant’, are completely locked out of using any banking options at all. Instead of depositing money like any other state-legal entity, those cannabis companies have to transport and store large amounts of cash making them a huge target for people with nefarious intent.

For the lucky companies who do initially get a bank account, the banking access often proves to be short-lived, with the account being shut down. Cannabis companies getting their bank accounts canceled with little to no notice is unfortunately a common phenomenon, and those companies are then left scrambling to look for other options.

We are not talking about small potatoes here. It is estimated that the legal cannabis industry in the United States sold as much as $21.6 billion in cannabis products in 2020. The State of California alone sold roughly $4.4 billion in cannabis flower and other cannabis products such as vaporizer cartridges, edibles, and topicals.

Colorado sold over $2.1 billion in 2020 and surpassed the $10 billion all-time mark for total legal sales within the state’s borders. A significant amount of the legal transactions in legal states involved cash, and much of that cash went somewhere other than a bank for storage which is far from optimal.

Band-Aid Solution: The SAFE Banking Act

In 2019 a federal measure was introduced which sought to fix the banking issue for the cannabis industry and allow companies to have nearly unfettered access to the nation’s banking system. The SAFE Banking Act was passed by the United States House in September 2019, making it the first standalone cannabis measure to ever be passed by a full chamber of Congress.

Unfortunately, the Senate did not pass the measure. Cannabis enthusiasts were hopeful that it would at least get a shot to be debated by the Senate, however, then-Senate leader Mitch McConnell single-handedly prevented that from happening and the bill didn’t see the light of day in the Senate.

The SAFE Banking Act is back again this year, with United States Representative Ed Perlmutter (CO-07) re-introducing the bill in mid-March. The bill was authored by Perlmutter and is sponsored by Representatives Nydia M. Velázquez (D-NY-07), Steve Stivers (R-OH-15), and Warren Davidson (R-OH-08), and is also co-sponsored by more than 100 other members of the U.S. House.

As it’s introduced, the SAFE Banking Act prevents federal banking regulators from taking many actions against banks who work with cannabis companies, including terminating or limiting insurance to those banks. Cannabis company deposits would no longer be considered as sourced from ‘unlawful activities’ like they are now. The bill also indemnifies bank leadership from being held liable for conspiracy-type charges.

The Safe Banking Act Doesn’t Go Far Enough

While the Safe Banking Act helps solve many problems facing the emerging cannabis industry, it has at least one glaring deficiency - no provisions freeing up major U.S. stock exchanges to list U.S. cannabis companies.

One of the greatest examples of how backwards cannabis policy is in the United States right now can be found in the current status of cannabis stock listings on major U.S. exchanges. Canadian cannabis companies are listed on the NASDAQ and on the New York Stock Exchange (NYSE). The first to do so was Cronos in 2018, and since that time several other Canadian cannabis companies have followed suit.

United States cannabis companies, on the other hand, are still prohibited from listing on NASDAQ and the NYSE, and instead list on the Toronto Stock Exchange. If you are wondering how that makes sense, you are not alone because it’s clearly nonsensical.

The omission of provisions in the SAFE Banking Act that would help U.S. cannabis companies list on the major stock exchanges is truly unfortunate. Canadian cannabis companies are getting an enormous advantage over their U.S. counterparts when raising funds from the public in the U.S.

It’s not too late for provisions to be added via an amendment. If lawmakers want to truly help U.S. cannabis companies they need to do more than just provide banking relief. Banking reform is needed, and the SAFE Banking Act is obviously better than the status quo, however, the legislation needs to be used as an opportunity to fix as many financial problems for the emerging legal cannabis industry as possible and serve as a comprehensive overhaul rather than just a partial solution.

You don't want to miss out on GREAT cannabis content - or do you? Sign Up for The Bluntness newsletter today (it's free!).